Protect more lives faster

A single application for multiple lives, insurers and products.

Trusted by the UK's leading insurers

Say hello to how life should be

- One application for 10 providers

- Underwritten prices in real time

- Clear evidence for consumer duty purposes

- Save application and continue later

- Total clarity before recommendation

- Quote and buy

How it works

1. One application for all

Gain access to accurate and fully underwritten protection premiums from multiple providers.

2. Real time fully underwritten premiums

Keep your clients satisfied by managing their expectations with instant access to live premiums in line with the disclosures provided.

3. Compare and buy

Compare products and make informed decisions effortlessly with our integrated product comparison tools.

Join our demo

Join our 30 minute demo held monthly, where our experts will guide you step-by-step through The Protection Platform explaining how it works and answering any questions you may have.

Frequently asked questions

Haven't found what you are looking for?

Please reach out to info@underwriteme.com

How to register on The Protection Platform?

To set your account up we need to take some information from you.

- Fill in the registration form by providing your individual details and company information.

- We will then register your company and provide access to the advisers once we have verified the terms of business with the insurers.

How does The Protection Platform help with pre-sales enquiries?

The Protection Platform offers fast and fully underwritten quotes from multiple insurers based on their rules engines which advisers can convert to full applications later to submit to the insurer of their choice. No need to pick up the phone and call all the insurers separately.

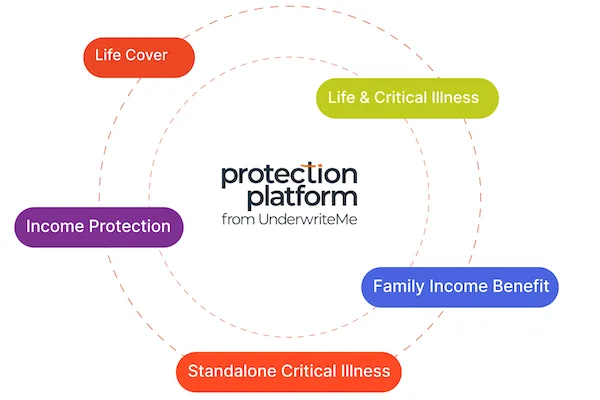

How do I add multiple products to the application?

Once the personal details have been captured you will be taken to the next page where you will be able to select from 5 different products. Simply select the product, complete the required information on the page, and select “Yes” to add another product. You can see all products selected as part of the application for the different lives.

How does The Protection Platform help to understand the decision in terms of terms being offered along with the exclusions?

Using The Protection Platform, advisers can very clearly understand why the price has changed based on any new disclosures and also outline the exclusions and specific reasons regarding why the terms of the decision are updated.

How does The Protection Platform help with Compliance?

We are integrated with 3 industry-known quality analysis systems - Defaqto, CI Expert and Protection Guru Pro.

Using the benchmarking tools enabled in The Protection Platform, Advisers can easily compare different provider products and key features versus competitor offerings. The comparison tools helps drive client conversions and customer retention - it facilitates instant provider and product identification which allows advisers to have factual conversations with clients whilst discussing the various provider USPs.

Does The Protection Platform support CRM Integrations?

Another key part of creating a single sourcing solution is integrating The Protection Platform into CRM systems. The great news is that The Protection Platform is integrated with leading CRM platforms including Intelliflo, FinPlan and 360 dotnet. The Protection Platform is also integrated with leading product research platforms including Protection Guru Pro, CI expert and Defaqto. We are connected to your existing CRM systems to save you time and improve accessibility.

Haven't found what you are looking for?

Please reach out to info@underwriteme.com